Political Financing Handbook for Registered Parties and Chief Agents (EC 20231) – October 2017 – Archived Content

This document is Elections Canada's archived guideline OGI 2017-03 and is no longer in effect.

An updated version of this document is available in Tools for Political Parties.

2. Contributions

This chapter defines what is and is not a contribution, explains the rules for administering contributions and provides practical examples. It covers the following topics:

- What is a contribution?

- What is commercial value?

- Who can contribute to whom and how much?

- Are paid leave, volunteer labour, convention fees, and sponsorship or advertising contributions?

- What are the rules for contribution receipts, anonymous contributions and ineligible contributions?

What is a contribution?

A contribution is donated money (monetary contribution) or donated property or services (non-monetary contribution).

| Monetary contribution | Non-monetary contribution |

|---|---|

| A monetary contribution is an amount of money provided that is not repayable. Monetary contributions include cash, cheques or money orders, credit card or debit card payments, and contributions made using online payment services. |

The amount of a non-monetary contribution is the commercial value of a service (other than volunteer labour) or of property, or the use of property or money, to the extent that it is provided without charge or at less than commercial value. This includes forgone interest on loans. |

What is commercial value?

Non-monetary contributions are recorded at commercial value. Commercial value, in relation to property or a service, is the lowest amount charged at the time that it was provided for the same kind and quantity of property or service, or for the same use of property or money, by:

- the person who provided the property or service (if the person who provided it is in that business), or

- another person who provides that property or service on a commercial basis in the area (if the person who provided the property or service is not in that business)

Note: If the commercial value of a non-monetary contribution is $200 or less, and it is from an individual not in that business, the contribution amount is deemed to be nil.

Examples

- An individual who is not in the business of renting office supplies lends a photocopier to the registered party's office for the duration of the campaign. The chief agent or a registered agent has to determine the commercial value of this non-monetary contribution by checking with local suppliers to see how much they would charge for renting similar equipment for the same period. If that amount is greater than $200, a non-monetary contribution must be reported.

- A self-employed individual in the business of providing information technology services offers to set up the computers in the registered party's office and does not charge for the service. This is a non-monetary contribution from that person. The commercial value is equal to the lowest amount charged by that individual for the same kind of service.

Who can contribute?

Only individuals who are Canadian citizens or permanent residents of Canada can make a contribution to a registered party, a registered association, a candidate, a leadership contestant or a nomination contestant.

Contributions can be accepted from minors, but political entities should consider whether the person is contributing willingly and using their own property or money.

Note: Corporations, trade unions, associations and groups cannot make contributions.

Limits on contributions, loans and loan guarantees to a registered party

This table displays the limits for registered parties. The limits for all entities are available in Chapter 1, Reference Tables and Timelines.

| Political entity | 2017 annual limit | Limit per election called between Jan. 1, 2017 and Dec. 31, 2017 |

|---|---|---|

| To each registered party | $1,550* | n/a |

Notes

- The contribution limits apply to total contributions, the unpaid balance of loans made during the contribution period, and the amount of any loan guarantees made during the contribution period that an individual is still liable for.

- The sum of these three amounts cannot at any time exceed the contribution limit.

There are some exceptions to the limits on contributions:

- Fees collected for membership in a registered party of no more than $25 per year for a period of no more than five years are not contributions. For example, a party could charge $125 for a five-year membership without a contribution being made. However, this exception applies only if the payment is made by the individual who wishes to become a member of the registered party.

*The limits increase by $25 on January 1 in each subsequent year.

Examples

- Max decides to contribute $1,550 to the registered party he supports. In addition, he makes a $550 contribution to the party's registered association in his riding. When a federal election is called in the same year, he makes a $1,000 contribution to the candidate representing the party in his riding. With that, Max reaches the annual limit for contributions to the registered party as well as the annual limit for contributions to any combination of candidates, registered associations and nomination contestants of the registered party. He could still make a contribution to political entities of other registered parties.

- Clara made a $1,550 contribution to the registered party she supports. Later that year an election is called and Clara makes another $100 contribution to the same party. The chief agent, however, is aware of the contribution made earlier in the year and returns the cheque to Clara because she has already reached her annual limit.

- Peter gave a $1,550 loan to a registered party early in the year. The full amount is still outstanding on December 31. Consequently, Peter could not have made another loan, contribution or loan guarantee that year to the registered party. The sum of contributions, loans and loan guarantees cannot at any time exceed the contribution limit.

Note: These examples use the limits in effect for 2017.

Volunteer labour is not a contribution

Registered parties often rely on the help of volunteers. Volunteer labour is any service provided free of charge by a person outside of their working hours. Volunteer labour is not a contribution.

Note: A service provided by a self-employed person who normally charges a fee for that service is a non-monetary contribution and is not volunteer labour. The person providing the service has to be eligible under the contribution rules.

Examples

- A person who is employed as a teacher offers to work in the evenings in the registered party's office to answer the phone and help with general office duties. This is volunteer labour and therefore is not a contribution.

- A self-employed graphic designer offers to design a pamphlet for the registered party free of charge. Because the person is self-employed and normally charges for that service, the pamphlet design is not volunteer labour. The commercial value of the service has to be recorded as a non≠monetary contribution. In this case, the commercial value is the lowest amount the graphic designer normally charges for that service.

Party convention or leadership convention fees are contributions

The payment of fees by or on behalf of an individual to attend a party convention or a leadership convention is a contribution to the registered party.

The contribution amount is the difference between the amount paid by the individual and the commercial value of any tangible benefits received. Tangible benefits include meals, lodging and any other tangible goods or services directly received by the convention attendee. The general expenses incurred by the party in holding the convention, such as room or audiovisual equipment rental, would not be deducted from the convention fee.

Sponsorship or advertising at a political event is a contribution

A transaction involving the receipt of money by a political entity in exchange for advertising or promotional opportunities directed at members or supporters of the political entity is not recognized as a commercial transaction. Any money received as part of such an arrangement is to be treated as a contribution that is subject to the contribution limit and eligibility rules.

Example

The registered party holds a golf tournament as a fundraiser. The party encourages individuals to sponsor a hole: for $200, they can have their names printed on a small sign attached to the flag pole. The full amount paid by each individual is a contribution to the party. The party does not ask corporations or unions to sponsor a hole because only individuals can make contributions.

Accepting and recording contributions

Only the chief agent and authorized registered agents can accept contributions to the registered party.

| Contribution | What to do |

|---|---|

| Anonymous contributions | Anonymous contributions of $20 or less can be accepted. |

| Contributions over $20 and up to $200 | The contributor's full first and last name (initials are not acceptable) have to be recorded, and a contribution receipt must be issued. To issue a tax receipt, the agent has to record the contributor's address as well. |

| Contributions over $200 | The contributor's full first and last name (initials are not acceptable) as well as home address have to be recorded, and a contribution receipt must be issued. |

This table summarizes some important points about accepting contributions and issuing receipts.

| Contribution received | What to keep in mind |

|---|---|

| Cheque from a joint bank account |

|

| Through an online payment service |

|

| From a partnership |

|

| From an unincorporated sole proprietor |

|

Note: It is recommended that registered parties only accept contributions made by way of a traceable instrument.

Issuing contribution receipts

A receipt has to be issued for each monetary or non-monetary contribution over $20. Only the chief agent and authorized registered agents can provide official receipts for contributions, including tax receipts. Tax receipts can be issued only for monetary contributions.

It is recommended for the chief agent to use Elections Canada's Electronic Financial Return (EFR) software to issue all receipts. Please refer to the EFR User Guide for more information. The guide can be found under the Help menu within the EFR software. EFR is free and downloadable from the Elections Canada website.

Example

Clara contributed $500 to the registered party she supports. Later in the same year when an election was called, Clara contributed $300 to Peter, a candidate for that party in her riding. Clara will receive a receipt for $500 from the registered party and a receipt for $300 from Peter's campaign.

Determining the date a contribution is made

As most contribution limits apply per calendar year, the date a contribution is made is important. It is also important for reporting purposes because this same date will be used as the "date received" in the registered party's return.

The date a contribution is made is generally the date the contribution is in the hands of the chief agent or an authorized registered agent. There are exceptions for contributions made by regular mail, by post-dated cheque and electronically.

| How contribution is made | Date contribution is made |

|---|---|

| In person | The date the contribution is in the hands of the chief agent or an authorized registered agent. |

| By regular mail | The date of the postmark on the envelope. If the postmark is not legible, the contribution is made on the date the agent receives the mail. The party should keep the stamped envelope as part of its records. |

| Post-dated cheque by any means | The date on the cheque. |

| Electronically (e-transfer, credit card, PayPal, etc.) | The date the contributor initiates the transaction. If the transaction is post-dated, the contribution is made on the date specified by the contributor. |

Examples

- On December 23, 2016, an individual goes to the registered party's office and gives a cheque in the amount of $300, dated for the previous day. The chief agent deposits the cheque on January 10, 2017. The contribution is made on December 23, 2016. The chief agent issues a receipt for 2016, and the amount counts toward the individual's 2016 contribution limit.

- An individual makes an e-transfer to the registered party on December 23, 2016, but the chief agent does not process the amount until January 10, 2017. The contribution is made on December 23, 2016. The chief agent issues a receipt for 2016, and the amount counts toward the individual's 2016 contribution limit.

- The chief agent receives a cheque from a contributor in the mail on January 5, 2017. The cheque is dated December 28, 2016, and the postmark on the envelope is December 30, 2016. The contribution is made on December 30, 2016. The chief agent issues a receipt for 2016, and the amount counts toward the individual's 2016 contribution limit.

- The chief agent receives a cheque from an individual and deposits it in the registered party's bank account. A few days later, when checking the account online, the chief agent notices that the bank has charged the account a fee because the cheque did not have sufficient funds. No contribution has been made and the bank charge is an expense. If the contributor issues a new cheque later, the contribution is made on the date associated with the new contribution.

Recording anonymous contributions

If anonymous contributions of $20 or less are collected during an event related to the party, the chief agent or an authorized registered agent has to record:

- a description of the function at which the contributions were collected

- the date of the function

- the approximate number of people at the function

- the total amount of anonymous contributions accepted

Anonymous contributions of $20 or less may also be received outside the context of a particular function. In that case, the chief agent or a registered agent has to keep track of the total amount collected plus the number of contributors.

Example

Volunteers of the registered party organize a wine and cheese event one evening and invite local residents. Approximately 40 people show up. During the evening, the chief agent passes a basket around to collect cash contributions from the attendees. She informs the guests about the contribution rules: a maximum of $20 can be accepted from any one individual as an anonymous cash contribution. At the end of the evening there is $326 in the basket.

After the event the chief agent has to record the following: a description and the date of the event, the approximate number of people who attended (40), and the amount collected in anonymous contributions ($326). The chief agent has to deposit the amount into the party's bank account.

Remitting anonymous contributions that cannot be accepted

If the chief agent or a registered agent receives a contribution that is:

- over $20 and the name of the contributor is not known, or

- over $200 and the name and address of the contributor are not known

the chief agent has to send a cheque for the amount without delay to Elections Canada, payable to the Receiver General for Canada.

Ineligible contributions

The chief agent and registered agents are responsible for ensuring that contributions are in accordance with the rules set out in the Canada Elections Act.

The following contributions are ineligible:

- cash contributions over $20

- contributions from corporations, trade unions, associations and groups

- contributions that exceed the limit

- indirect contributions (no individual can make a contribution that comes from money, property or the services of another person or entity)

- contributions from an individual who is not a Canadian citizen or a permanent resident

- contributions an individual makes as part of an agreement to sell goods or services, directly or indirectly, to a registered party or a candidate (for example, a registered party cannot agree to buy signs from a local dealer in exchange for a contribution)

Returning or remitting ineligible contributions

The chief agent or a registered agent must not knowingly accept a contribution that exceeds the limit. It is also advisable not to accept any other type of ineligible contribution.

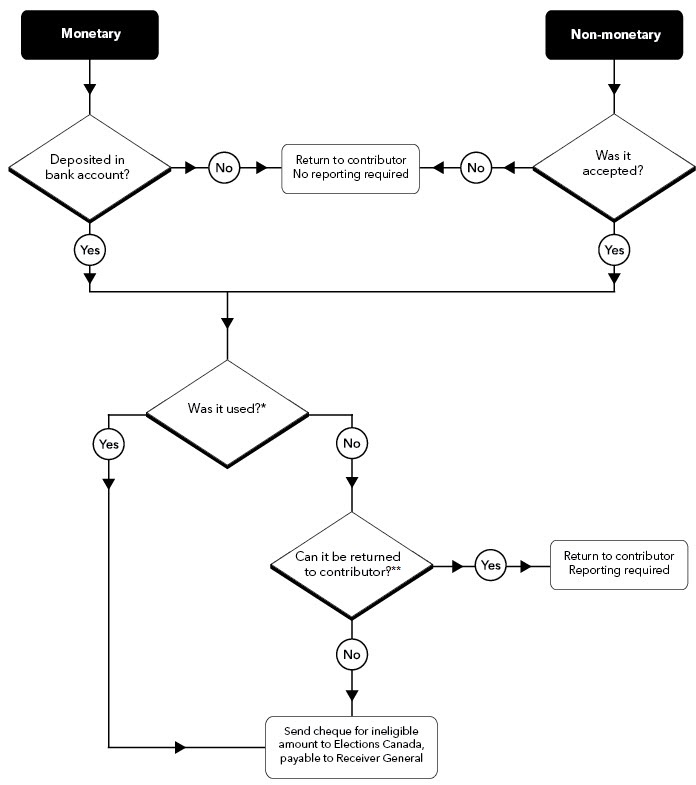

The chief agent has to return or remit a contribution within 30 days of becoming aware that it is ineligible. It must be returned to the contributor or remitted to Elections Canada, based on whether or not the contribution was used.

A monetary contribution is considered used if the party's bank account balance fell below the ineligible amount at any time after the contribution was deposited into the bank account.

Flowchart 1 explains how to administer ineligible contributions in different scenarios.

Examples

- The chief agent of a registered party deposits a cheque for $600 from a contributor. When he enters the contribution in the books, he notices that the same person has already contributed $1,000 in that year. Within 30 days, assuming the money has not been spent, the chief agent has to issue a cheque for the excess amount, $50, and send it to the contributor. He records a returned contribution of $50.

- The chief agent receives a cheque for $2,000 from a contributor. As this is obviously an over‑contribution, the chief agent cannot deposit the cheque. She sends it back to the contributor uncashed, and no reporting is required.

- An individual makes a non-monetary contribution to the party by offering the use of office equipment for a week. The chief agent later realizes that the commercial value of renting the same office equipment is $1,700, which is higher than the contribution limit. The equipment was used, so he sends a cheque for the excess amount of $150 to Elections Canada, payable to the Receiver General for Canada. He records a contribution of $1,700, a returned contribution of $150 and an expense of $1,700.

- The chief agent receives a notice from Elections Canada a couple of months after the reporting deadline. It states that a person who contributed $1,000 to the party on two occasions exceeded the annual limit by $450. Since the deposit date of the second contribution, the registered party’s bank account balance had fallen below the ineligible amount of $450 and the funds were therefore used. The chief agent must remit $450 within 30 days of becoming aware of the contravention. To obtain funds, she could organize a fundraising event or request a transfer from an affiliated political entity. Once the money is available, the chief agent sends a cheque for the excess amount to Elections Canada, payable to the Receiver General for Canada. She records a returned contribution of $250.

Note: These examples use the limits in effect for 2017.

Flowchart 1: Returning or remitting ineligible contributions

Text Description "Flowchart 1: Returning or remitting ineligible contributions"

*A monetary contribution was used if the party's bank account balance fell below the ineligible amount at any time after the contribution was deposited into the bank account.

**For example, the contributorís address is known and there are no obstacles to prevent the return.