Political Financing Handbook for Candidates and Official Agents (EC 20155) – April 2024

7. Fundraising

This chapter explains what portion of an amount given during a fundraising activity is a contribution and clarifies when fundraising expenses are election expenses. It covers the following topics:

- Determining the contribution amount when contributors receive a benefit

- Fundraising expenses

- Regulated fundraising events

- Typical fundraising activities (sale of branded goods, auctions, ticketed events, non-ticketed events and draws)

Determining the contribution amount when contributors receive a benefit

As part of fundraising, a candidate's campaign might provide a benefit (T-shirt, dinner, etc.) to a contributor in exchange for a contribution. It is important to determine what portion of the money given is a contribution.

Flowchart 2 shows the basic rules for making that calculation.

Flowchart 2: Basic rules for determining the contribution amount

Text version of "Flowchart 2: Basic rules for determining the contribution amount"

This flowchart shows the basic rules for determining the contribution amount when contributors receive a benefit in exchange for their contribution as part of a fundraising activity.

If the benefit is not commercially available, the full amount given is a contribution. If the benefit is commercially available, determine the fair market value of the benefit before continuing.

Then, if the benefit is commercially available and central to the fundraising activity, deduct the fair market value of the benefit from the amount given to arrive at the contribution amount.

On the other hand, if the benefit is not central to the fundraising activity, determine whether the benefit is significant using the de minimis threshold. If the benefit is significant, deduct the fair market value of the benefit from the amount given to arrive at the contribution amount. If the benefit is not significant, the full amount given is a contribution.Note: Terms used in the flowchart are explained in the sections below.

What is a benefit's fair market value?

The fair market value of a benefit is generally the amount the candidate's campaign paid a commercial provider for the property or service (that is, the retail price). This value may need to be deducted from the amount given by a contributor to arrive at the contribution amount.

If a benefit is not commercially available, such as access to a party leader, it has no fair market value. Nothing is deducted to arrive at the contribution amount.

When is a benefit central?

A benefit is central to a fundraising activity when it is a focal point of the activity. For example, items sold at an auction or branded goods sold in an online store are central to those fundraising activities.

The fair market value of benefits central to a fundraising activity is deducted from the amount given by a contributor to arrive at the contribution amount.

When is a benefit significant?

A benefit is considered significant when its fair market value exceeds 10% of the amount given or $75, whichever is less. This is called the de minimis threshold. When a benefit is significant, its value is deducted from the amount given by a contributor to arrive at the contribution amount.

If the contributor receives multiple small benefits, their values are added together to determine whether the overall benefit is significant in relation to the full amount given.

The de minimis threshold does not apply to cash or near-cash benefits, such as gift certificates, nor to items that are central to a fundraising event, such as the meal at a ticketed fundraising dinner. These are always deducted as part of the benefit.

Note: The de minimis threshold of 10% of the amount given or $75 is aligned with the threshold used by the Canada Revenue Agency to determine the eligible amount and the amount of an advantage for both political and charitable contributions.

OGI reference

For a detailed discussion of this topic, please refer to Elections Canada's interpretation note 2016-01, Fundraising, on the Elections Canada website.

Examples

- In exchange for making a $500 contribution, an individual gets to meet one-on-one with a high-profile candidate. The full amount given is a contribution under the Canada Elections Act.

Note: Under Canada Revenue Agency rules, this contribution is not eligible for a tax receipt because the value of the advantage cannot be determined. - The candidate's campaign rents an inflatable castle as a fundraiser and charges families $30 for admission. The prorated cost of the castle per family, based on expected attendance, is $3. Since the castle is central to the fundraising activity, $3 is deducted from the amount given and the contribution is $27. This is true even though the fair market value does not exceed 10% of the amount given or $75.

- In exchange for making a $20 contribution, contributors receive a box of chocolates. The cost of the chocolates was $5. Since the value of the chocolates exceeds 10% of the amount given, $5 is deducted from the amount given and the contribution is $15. This is true even though the chocolates are not central to the fundraising activity.

- Contributors who make a $100 contribution receive a keychain with the party logo. The cost of the keychain was $5. Since the keychain is not central to the fundraising activity and its value does not exceed 10% of the amount given or $75, nothing is deducted from the amount given and the contribution is $100.

Fundraising expenses

Most expenses reasonably incurred for property or services used during the election period are election expenses. When it comes to fundraising, some expenses are exceptions to that rule:

- contribution processing fees

- expenses for a fundraising activity, other than promotional expenses

The term "processing fees" means the expenses for processing contributions, which may include bank charges, credit card processing fees, fees for other payment services (such as PayPal), salaries of fundraising staff and salaries for data entry when contributions are received.

While the above expenses related to a fundraising activity are not election expenses, any expense related to promoting the fundraising activity is. Examples include:

- producing and distributing invitations to a ticketed fundraiser

- procuring and distributing promotional items, such as pens or T-shirts

- producing and mailing a letter or pamphlet that solicits contributions

- producing and using a script for telephone calls that solicit contributions

Note: During an election period, a registered association might conduct a fundraising activity and accept the related contributions. Promotional expenses for the activity must be authorized in advance by the official agent and reported as the candidate's election expenses, whether the association invoices the campaign for the expenses or provides a non-monetary transfer. The association should report the remaining expenses in its own return.

Activities not directly linked to soliciting contributions

Expenses incurred by the candidate's campaign for activities conducted during an election period that are not directly linked to soliciting contributions are also election expenses. In these cases, incurring an expense and accepting a contribution are separate transactions.

Examples of such activities include:

- non-ticketed events held to promote a candidate, where contributions are also solicited

- door-to-door promotion of a candidate, where contributions are also solicited (in this case, salaries or other amounts paid to canvassers are election expenses)

- contacting electors by phone or by other means to promote a candidate, where contributions are also solicited (in this case, salaries paid to staff are election expenses)

Regulated fundraising events

What is a regulated fundraising event?

A regulated fundraising event is an event that meets all these conditions:

- it is organized to financially benefit a registered party with a seat in the House of Commons (or, during a general election, a party that had a seat on dissolution) or one of its affiliated entities

- it is attended by one of these prominent people: the party leader, the interim leader, a leadership contestant or a federal Cabinet minister (minister of the Crown or minister of state)

- at least one person had to pay or contribute over $200 to attend or to have another person attend

Note: Events held in person, online or by telephone are all potentially regulated. A prominent person is "attending" if they are present at the event in real-time. By contrast, if they are present only by prerecorded video or audio message, they are not attending the event.

It excludes the following events:

- a leadership debate

- a party or leadership convention

- a donor appreciation event at a party or leadership convention

- an event where at least one person gave over $200 to attend or to have another person attend but no part of these amounts was a contribution

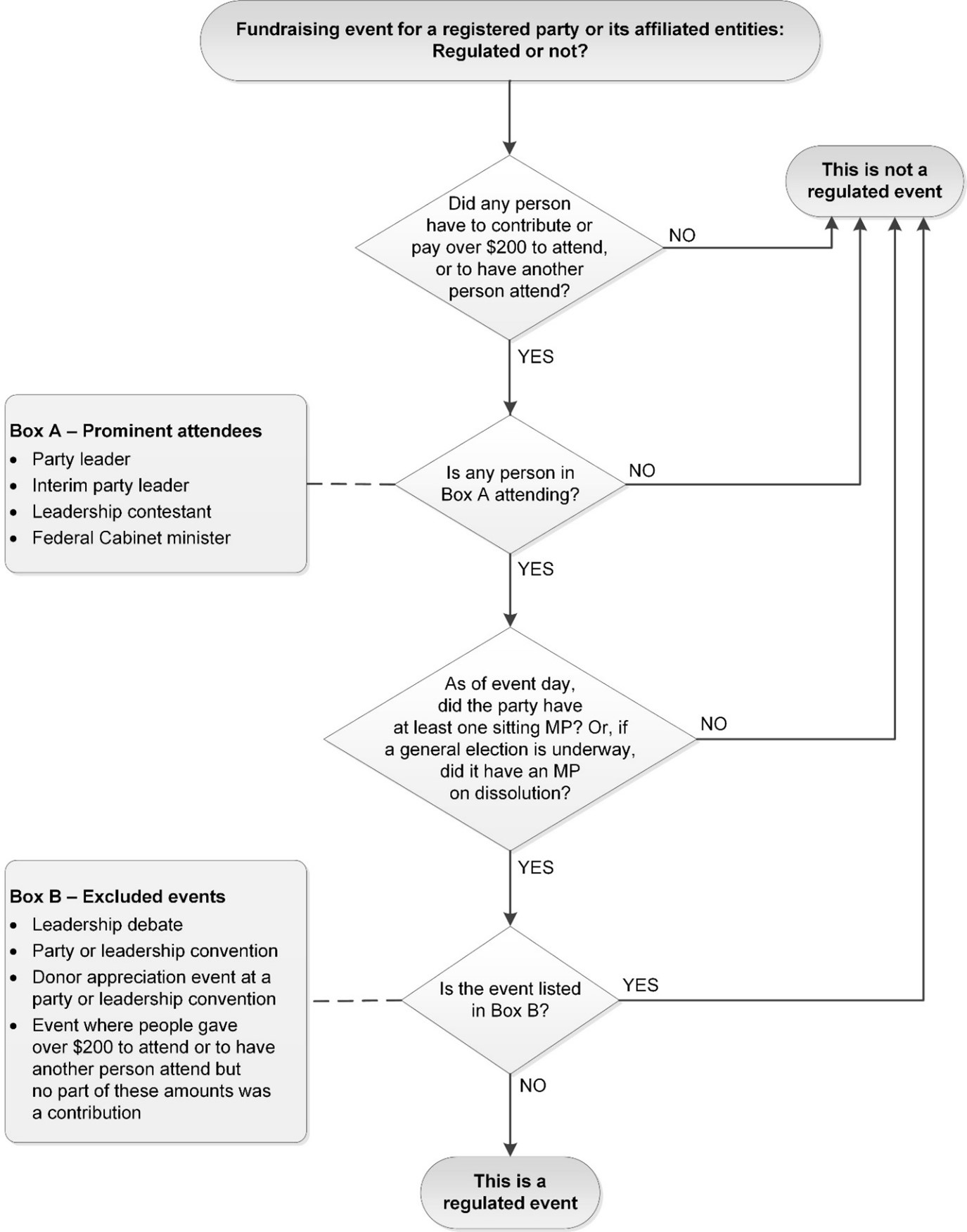

Flowchart 3 can be used to check whether a fundraising event is regulated.

Any person can attend an event, even if they are not a Canadian citizen or permanent resident, as long as they did not make a contribution in order to attend. For example, an eligible contributor can pay to bring a foreign guest.

Note: Fundraising events organized after an election or a contest for the financial benefit of a candidate or a contestant continue to fall under these rules.

Are leadership contestants after a contest period and ministers during an election still prominent attendees?

Leadership contestants continue to be contestants and prominent attendees after the contest period, until they have fulfilled their reporting obligations (for example, after they have paid their claims and loans, disposed of surplus and closed the bank account).

Leadership contestants should wait for confirmation from Elections Canada, following its review of their financial returns, that they are no longer prominent attendees.

Ministers continue to be prominent attendees during an election.

Note: A regularly updated list of leadership contestants who are prominent attendees is available on the Elections Canada website under Political Financing > View Regulated Fundraising Events.

Examples

- Barbara paid the $250 ticket price to attend a wine and cheese organized to benefit a candidate. The guest of honour is a federal Cabinet minister who supports the candidate. This is a regulated fundraising event. Even though Barbara's contribution is only $190 after the benefit is deducted, the event is still regulated because the ticket price was over $200 and part of the payment was a contribution.

- Mehdi paid the $225 entrance fee to play in a baseball tournament organized to benefit a candidate. The candidate is attending but there will be no prominent attendees from the party. This is not a regulated fundraising event.

- A candidate's campaign charges $250 for participants to join a virtual event held on a videoconferencing platform. A Cabinet minister who supports the candidate will also be online, interacting with attendees. This is a regulated fundraising event.

- The candidate's campaign sells tickets to its fundraising dinner with the party leader for $150 each. Jim buys a table of tickets for $1,200 and brings his family. Even though he paid more than $200 total for himself and his guests, no single person was required to pay over $200 to attend. This is not a regulated fundraising event. This event would be regulated if a person had to buy a whole table.

- As a thank-you to contributors, a candidate and party leader hold a teleconference with individuals who regularly contribute $1,500 or more per year. This is a regulated fundraising event.

Flowchart 3: Regulated fundraising events

Text version of "Flowchart 3: Regulated fundraising events"

This flowchart shows the basic rules for determining when a fundraising event for a registered party or its affiliated entities is regulated or not.

If all five of the following conditions are met, the event is regulated:

- any person had to contribute or pay over $200 to attend, or to have another person attend

- the party leader, the interim party leader, a leadership contestant or a federal Cabinet minister is attending

- as of event day, the party had at least one sitting MP or, if a general election is underway, it had an MP on dissolution, and

- the event is not an excluded event

Excluded events are a leadership debate, party or leadership convention, donor appreciation event at a party or leadership convention, and events where guests paid over $200 to attend but no part of the payment was a contribution.

Candidate's role in providing information about a regulated fundraising event

When a fundraising event is regulated, the registered party has to follow certain disclosure rules to avoid forfeiting contributions received as part of the event.

If the candidate's campaign was involved in the event, it may need to provide the party with information so that the party can follow the disclosure rules.

| If all or part of the event was organized by the registered party | The candidate's campaign has no official role to play in providing information to the party. |

|---|---|

| If all of the event was organized by the candidate’s campaign or other persons or entities | The candidate's campaign and other organizers have to give the party the information it needs to follow the disclosure rules. See details in the next section. Information must be provided far enough in advance of the disclosure deadline so that the party has time to publish or report on it. Note: If an event was organized by more than one candidate's campaign, they should coordinate sending information to the party. |

Information to provide outside and during a general election

The registered party needs information at different times, based on whether a regulated fundraising event is held outside or during a general election.

| Before the fundraising event | After the fundraising event |

|---|---|

Provide this information so that the party can publish an event notice 5 days before the event:

For events held virtually, the venue name can be "online" or "teleconference." No address needs to be provided. |

Provide this information so that the party can submit a report to Elections Canada within 30 days after the event:

|

| Before the fundraising event | After the fundraising event |

|---|---|

| No information is required | Provide this information for each event held during the election period so that the party can submit a single report to Elections Canada within 60 days after election day:

|

*In addition to minors, attendees are not listed in the reports if they attended solely for the following purposes:

- to assist someone with a disability

- as an employee involved in organizing the event

- as part of a media organization or as a freelance journalist

- as a member of security or support staff for the prominent attendee who led to the event being a regulated event

- to provide volunteer labour

Note: If the candidate's campaign is aware of changes to the information it provided, it must notify the party as soon as possible so that the event notice or report can be updated.

Note: For virtual events, it may be difficult to control attendance and produce an accurate list of attendees. Organizers should exercise due diligence so that an accurate report of all attendees can be filed. For example, they could advise people who sign up for an event that attendance is being published and that the link or phone number to attend is for their use only.

Examples: Event notices on a party website

- Fundraising dinner (event name is optional)

January 1, 2024, at 7:00 p.m.

ABC Restaurant, Ottawa, ON, A0A 0A0

In support of: Candidate X

Featuring: the Honourable Mary Marcel

Tickets: $250

More information: Paul Parcel at paul@candidate-x.ca - Donor appreciation event* (event name is optional))

January 2, 2024, at 7:30 p.m.

ABC Event Space, Vancouver, BC, A0A 0A0

In support of: Candidate Y

Featuring: Sally Sorel and Gavin Gorel

Contribution: $150–$500

More information: Paul Parcel at 1-800-000-0000

*Other than a donor appreciation event at a party or leadership convention, which would not be a regulated fundraising event.

Note: For the party website notice to be compliant, all the elements required for disclosure must appear in the notice at least five days before the event. The elements must then be adjusted as soon as feasible if the information is incorrect or has changed.

Returning contributions for non-compliance with disclosure rules

If the disclosure rules are not followed, the political entity that received monetary or non-monetary contributions in respect of the regulated fundraising event must return them to the contributor or remit their amount to Elections Canada.

Any of these circumstances may require contributions to be returned:

- outside a general election, the registered party fails to publish an event notice or notify Elections Canada about the event five days before it is held

- the registered party fails to submit a report by the deadline or extended deadline, or includes the name or address of a person excepted from the list of attendees (for example, a minor)

- an organizer fails to give the registered party information about an event in time for the party to publish an event notice or submit a report, or provides the name or address of a person excepted from the list of attendees (for example, a minor)

- an organizer fails to notify the registered party of changes to the information it provided

- the registered party fails to update an event notice on its website or a report to Elections Canada when it becomes aware of changes to the information

Where the non-compliance relates to incorrect information in an event notice or report, updating the notice or correcting the report as soon as feasible after becoming aware of the change or incorrect information will in most cases bring the party into compliance, so that contributions do not have to be returned. However, this is not the case if the event notice on the party website was missing information five days before the event.

Determining the contribution amount to return

When contributions must be returned, the amount to return to each contributor or remit to Elections Canada is the contribution received from the individual in respect of the regulated fundraising event.

Both of these amounts must be returned to the contributor or remitted to Elections Canada, where applicable:

- the contribution amount, received through a ticket sale or entrance fee, that entitled the person to attend the event (that is, the ticket price or entrance fee less the fair market value of the benefit that the person was entitled to receive)

- any contribution received from the contributor during the regulated fundraising event

See the Ticketed fundraising events section below for information about calculating the contribution amount when benefits are received.

The table below explains how different scenarios affect the return of contributions.

| Scenario | Return of contributions for a non-compliant event |

|---|---|

| Participants were entitled to attend a donor appreciation event based on a previous contribution of $250. | The previous contributions are not returned. Only additional contributions collected during the event must be returned. |

| Participants were entitled to attend an event by paying a $250 ticket price. | The contribution amounts from ticket sales must be returned. Any additional contributions collected during the event must also be returned. |

| An event has a mix of participants who bought a ticket, made a previous contribution or attended for free. | All contributions received from ticket sales or collected during the event must be returned, even if some participants paid $200 or less to attend. The previous contributions are not returned. |

See Returning ineligible or non-compliant contributions in Chapter 3, Contributions, for more information on the process that needs to be followed when returning contributions.

OGI reference

For a detailed discussion of these topics, please refer to Elections Canada's guideline 2023-01, Regulated Fundraising Events, and interpretation note 2022-04, Disclosing the Location of a Regulated Fundraising Event, on the Elections Canada website.

Typical fundraising activities

This section explains how to manage various fundraising activities.

Sale of branded goods

Candidates may sell branded goods in an effort to promote themselves and, in some cases, generate contribution revenue.

Contributions

When a branded good is sold for more than its fair market value (that is, more than the amount the campaign paid a commercial provider for the item), the purchaser is making a political contribution. The de minimis threshold does not apply in this case because the branded good is central to the fundraising activity. (See When is a benefit central? above.) Therefore, regardless of the value of the goods that are sold, the contribution amount is always the sale price less the fair market value of the item purchased.

Because campaigns only need to issue receipts for contributions over $20, the sale of a branded good will require a receipt under the Canada Elections Act only when the sale price less the fair market value exceeds $20. If a purchaser buys multiple items, each unit sold is treated as a separate contribution from a separate contributor. The total amount of contributions of $20 or less and the total number of contributors are then reported under anonymous contributions of $20 or less.

Examples

- To raise funds, the campaign sells T-shirts with the candidate's name and party logo for $25. The T-shirts were purchased from a supplier for $10 each, so the contribution generated by each T-shirt is $15 ($25 – $10). An individual who supports the candidate buys two T-shirts. The official agent reports two anonymous contributions of $15. No receipt is required.

- The campaign sells laptop bags with the candidate's name for $75. The bags were purchased from a supplier for $50 each, so the contribution generated by each laptop bag is $25 ($75 – $50). An individual who supports the candidate buys a laptop bag from the candidate's booth in a mall. The salesperson records the contributor's name, address and purchase amount. The official agent later records the contribution and issues a receipt for $25.

Expenses

The expenses incurred to produce and distribute branded goods (in other words, promotional materials) that are distributed during an election period are election expenses.

Auctions

Campaigns may choose to raise funds through auctions, where property or services are sold to the highest bidder. An auction may lead to contributions from both the donor of the property or service that is auctioned and the winning bidder.

Donor's contribution

If the auctioned property or service is donated, its commercial value is a non-monetary contribution.

Note: If the commercial value of a non-monetary contribution is $200 or less, and it is from an individual not in the business of providing that property or service, the contribution amount is deemed to be nil.

Purchaser's contribution

An individual who buys an auctioned property or service makes a contribution if the bid amount exceeds the fair market value of the property or service. The fair market value is generally the amount that would be paid for the property or service in a commercial market.

Even if the fair market value of the item is $200 or less, its value is still deducted from the bid amount to arrive at the contribution amount. The de minimis threshold does not apply in this case because the sale of the property or service is the fundraising activity. (See When is a benefit central? above.) Therefore, regardless of the value of the auctioned property or service, the contribution amount is always the winning bid amount less the fair market value of the item.

However, if the auctioned property or service is not available on a commercial basis, the entire amount of the winning bid is a contribution under the Canada Elections Act. Note that under Canada Revenue Agency rules, this type of contribution is not eligible for a tax receipt because the value of the advantage cannot be determined.

Expenses

In most cases, when an auction is held during an election period, expenses incurred by the candidate to purchase property or services that will be auctioned are not election expenses, because fundraising expenses are excluded from that definition. However, because expenses for producing and distributing promotional materials are specifically included, if any of the auctioned items promote a party, its leader or a candidate (such as branded goods), the expenses incurred are election expenses.

Examples

- An individual donated a painting to a candidate's campaign for sale at an auction organized to raise funds for the campaign. A local art dealer appraised the painting at $450. During the auction, the winning bid for the painting was $600.

The contribution amounts are as follows:- The donor of the painting made a $450 non-monetary contribution to the campaign.

- The winning bidder made a monetary contribution equal to the amount paid less the fair market value of the painting: $600 – $450 = $150.

In addition, $450 (the painting's commercial value) is an electoral campaign expense not subject to the election expenses limit. - An individual (who is not in the business of selling office furniture) donated an office chair to a candidate's campaign for sale at an auction organized to raise funds for the campaign. The chair retails for $150. During the auction, the winning bid for the chair was $250.

The contribution amounts are as follows:- The donor of the chair made a non-monetary contribution to the campaign that is deemed to be nil (since the commercial value is $200 or less, and the chair was provided by an individual not in the business of selling chairs).

- The winning bidder made a monetary contribution equal to the amount paid less the fair market value of the chair: $250 – $150 = $100.

Ticketed fundraising events

When a fundraising event such as a dinner or a golf tournament is held for the primary purpose of soliciting monetary contributions through ticket sales (including events with an entrance fee), the amount of a ticket purchaser's monetary contribution is the ticket price less the fair market value of the benefit that the bearer is entitled to receive. The de minimis threshold may apply to benefits that are not central to the event. (See When is a benefit significant? above.)

Note: A ticketed event will sometimes be held for promotional purposes rather than to raise funds. If the campaign anticipates that its event expenses will be higher than ticket revenue, see the Other ticketed events section below for information on calculating the benefit and reporting expenses.

Benefit received

In the case of a ticketed fundraising dinner, the benefit received by each ticket purchaser includes the following:

- if the event is held in a rented venue, the cost of the room rental and catering (prorated)

- if the event is held in a restaurant, the amount the restaurant would normally charge for the meal

- if the event is held in a private venue, the fair market value of the meal; no value is attributed to the use of an individual's private residence

- door prizes (prorated) (de minimis threshold may apply)

- complimentary items such as pens or key chains (de minimis threshold may apply)

- rental of audiovisual equipment and other general expenses (prorated)

In the case of a ticketed golf tournament, the benefit received by each ticket purchaser includes the following:

- green fee (excluded for golf club members whose green fees are already paid)

- cart rental

- meal

- complimentary items (de minimis threshold may apply)

- door and achievement prizes (prorated) (de minimis threshold may apply)

- rental of audiovisual equipment and other general expenses (prorated)

In both cases, the fair market value of producing and distributing materials promoting the event, including ticket printing, is not included in the benefit received because attendees do not gain from such activities.

Note: Be sure to exclude sales taxes and gratuities from the cost of food and beverages when calculating the benefit received at a ticketed fundraiser. This aligns with the Canada Revenue Agency's guidance.

Calculation based on expected attendance

The fair market value of the benefit is prorated based on the expected rather than the actual number of attendees. For example, an individual will receive the same dinner in the same venue regardless of the actual number who attend.

This fixed value is important in terms of contribution limits: it is necessary to determine the amount of the ticket purchaser's contribution in advance of the event so that individuals do not unknowingly exceed their limit.

Note: The expected number of attendees used in the calculation has to be reasonably supported by evidence (size of room rented, number of meals ordered, etc.).

Expenses

When a ticketed fundraising event is held during an election period, most expenses incurred by the candidate are not election expenses because fundraising expenses are excluded from that definition. However, because expenses for producing and distributing promotional materials are specifically included, any such expenses incurred before or during the fundraising event are election expenses.

This includes expenses for promoting the event, printing tickets, and producing and distributing promotional items.

Examples

- A candidate's campaign holds a ticketed fundraising dinner in a rented venue. Fifty attendees are expected, and tickets are sold at $150 each. The event includes dinner, a pen with a logo for each attendee, and hockey tickets as a door prize. The campaign incurs the following expenses:

- room rental: $500 ($500 / 50 = $10 per attendee)

- catering, excluding sales taxes and gratuities: $1,500 ($1,500 / 50 = $30 per attendee)

- live band and audio equipment: $400 ($400 / 50 = $8 per attendee)

- hockey tickets: $400 ($400 / 50 = $8 per attendee)

- pen with logo: $10

The contribution amount for each ticket purchaser is determined as follows:

*In this case, the total value of benefits received that are not central to the fundraising dinner (the hockey tickets and pen) exceeds 10% of the amount given ($18 / $150 = 12%). Therefore, the benefit is considered significant and the de minimis threshold does not apply. The fair market value of these benefits is deducted from the ticket price.The contribution amount for each ticket purchaser is determined as follows Ticket price $150 Less: Room rental $10 Catering $30 Band and audio $8 Hockey tickets* $8 Cost of pen with logo* $10 Contribution amount $84 - A golf tournament is held during the election period to raise funds for the candidate's campaign. Participants are charged $300, and 100 individuals are expected to attend. The campaign incurs the following expenses:

- green fees: $5,000 ($5,000 / 100 = $50 per participant)

- cart rental: $4,000 ($4,000 / 100 = $40 per participant)

- golf shirt with party logo: $15

- door and achievement prizes: $300 ($300 / 100 = $3 per participant)

- mailing promoting the event: $800

The contribution amount for each participant is determined as follows:

*If a participant is a golf club member and would not be charged a green fee, the cost of that benefit is not deducted from the participation fee. The contribution amount is $260.The contribution amount for each participant is determined as follows: Participation fee $300 Less: Green fee* $50 Cart rental $40 Golf shirt** – Prizes** – Contribution amount $210

**In this case, the total value of benefits received that are not central to the golf tournament (the golf shirt and prizes) does not exceed 10% of the amount given ($18 / $300 = 6%) or $75. Therefore, the benefit is not considered significant and the de minimis threshold applies. The fair market value of these benefits is not deducted from the participation fee.

The $800 promotional expense is an election expense of the candidate, and the balance of the expense for the event is an electoral campaign expense not subject to the election expenses limit.

Note: If participants are given the opportunity to sponsor a hole at a golf tournament, rules and restrictions apply. See Sponsorship or advertising at a political event is a contribution in Chapter 3, Contributions.

Other ticketed events

A ticketed event will sometimes be held for promotional purposes rather than to raise funds. The candidate’s campaign anticipates that its event expenses will be higher than ticket revenues—it charges a ticket price or entrance fee simply to offset some of the costs. For these events, the contribution amount is the difference between the amount paid by the individual and the commercial value of any tangible benefits received.

Tangible benefits include such things as meals, drinks and gifts directly received by the attendee. The general expenses incurred by the campaign in holding the event, such as room or audiovisual equipment rental, would not be deducted from the ticket price.

Expenses

When a candidate’s campaign holds this type of event during an election period, the expenses incurred are election expenses because they relate to producing and distributing promotional materials. They are not directly linked to accepting contributions.

Note: Ticketed events held for promotional purposes may still be regulated fundraising events, even if fundraising is not their primary purpose. See the Regulated fundraising events section above.

Non-ticketed events

Campaigns may hold an event for which no tickets are sold (and no entrance fee is charged at the door), but where contributions are solicited and received. In this case, the amount of an attendee's contribution is not reduced by the value of any benefit received (for example, food or drink) because attendees would have received the benefit whether or not they contributed. The giving of a contribution and the provision of a benefit by the candidate are separate transactions. Any contributions received at non-ticketed events are simply contributions at the amount provided.

Expenses

When a candidate's campaign holds a non-ticketed event during an election period, the expenses incurred are election expenses because they are not directly linked to accepting contributions.

Example

The official agent organizes an event one evening during the election period. Light refreshments and appetizers are served while Christine, the candidate, outlines her platform and answers questions. The participants have the opportunity to make a contribution to Christine's campaign. Any contributions received are recorded at the amount provided. The expenses for the food, beverages, room rental, etc., are election expenses, together with the expense for flyers distributed during the evening.

Draws

An individual who purchases a ticket for a draw for the chance to win property or a service is making a contribution under the Canada Elections Act equal to the ticket price. A prorated portion of the prize value is not deducted from the ticket price because a value cannot be attached to the hope of winning.

Note: Under Canada Revenue Agency rules, this type of contribution is not eligible for a tax receipt because the value of the advantage cannot be determined.

Provincial or territorial regulations should be consulted prior to organizing draws or other lotteries. In jurisdictions where draws are permitted, a licence from the province or territory may be required.

Expenses

For candidates promoting a draw during an election period, the expenses incurred to promote the draw are election expenses, regardless of when the draw occurs.